Use Your Competitive Advantage

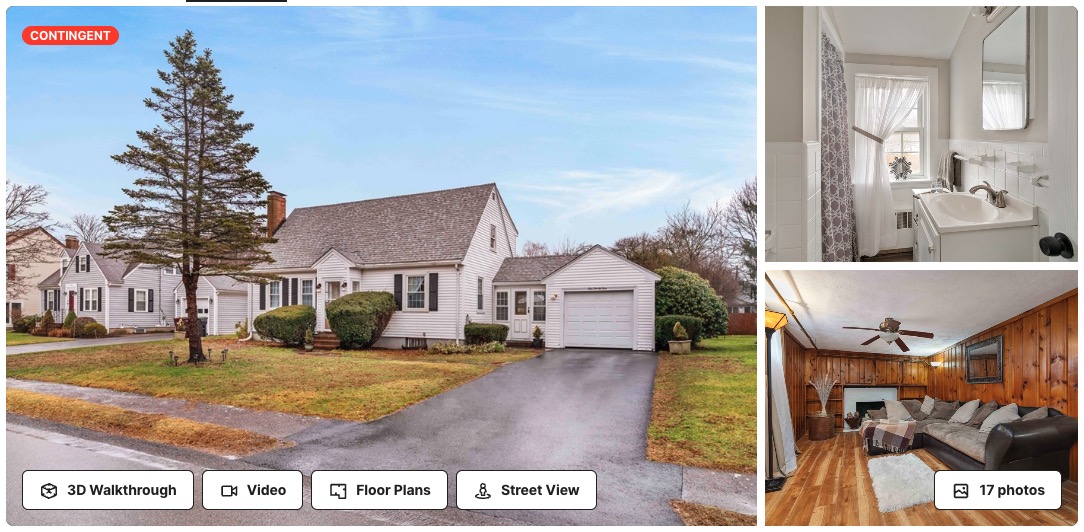

This is a house in Dedham, Massachusetts. This house was listed for sale on Thursday of last week and on Tuesday (5 days later) it was under agreement. There were 16 offers, many above asking. The winning bid was significantly higher than asking price, waved both inspection and mortgage contingency and went along with seller's request to stay at the house rent-free for several months after the sale. At the same time, the buyer also agreed to close in less than 20 days (eliminating the possibility of using conventional lender). The buyer basically has to use cash or hard money to make the purchase happen. Is there something special about this home? Is there something special about Dedham? Was this an amazing deal? The answer is none of the above.

This is a house in Dedham, Massachusetts. This house was listed for sale on Thursday of last week and on Tuesday (5 days later) it was under agreement. There were 16 offers, many above asking. The winning bid was significantly higher than asking price, waved both inspection and mortgage contingency and went along with seller's request to stay at the house rent-free for several months after the sale. At the same time, the buyer also agreed to close in less than 20 days (eliminating the possibility of using conventional lender). The buyer basically has to use cash or hard money to make the purchase happen. Is there something special about this home? Is there something special about Dedham? Was this an amazing deal? The answer is none of the above.

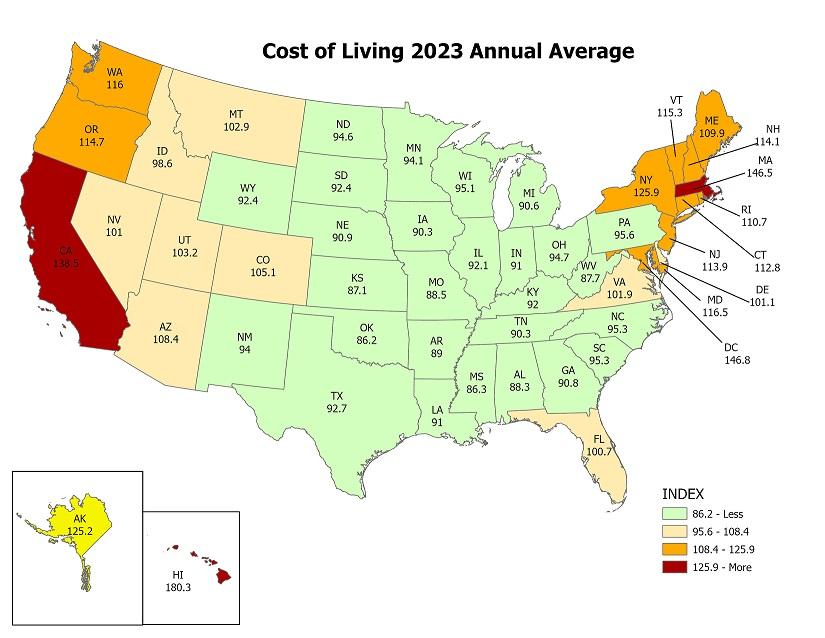

To understand what happened, we need to understand human psychology, and the concept of FOMO. You see, the sales agent priced this house really well (about $30k below comps). While this may seem like a lot, remember that this is Boston we're talking about, where starter homes cost $600k+ even in neighborhoods with mediocre schools. On top of that, we're approaching peak buying season (Spring) in what's already the hottest market in the country. That's right. For the first time in 50 or so years, Massachusetts housing market is actually more expensive than California, second only to Hawaii, as you can see from the chart below.

The agent's skillful pricing strategy resulted in websites like Redfin flagging this home with a "Hot Home" badge, resulting in even more eyeballs. The house itself was a cozy 3-bed/2-bath/1-garage home built in the 50s, with well-kept, but dated interior. It has a finished basement, 1500 square feet of space, and a kitchen that looks at least 20 years old. This home would sell for under $300k in Plano, a suburb of Dallas that's quite similar to Dedham (but with arguably a better school system, and no wokeness forced on your kids).

And while the listing price was very attractive for the area, the bidding war (which the agent skillfully orchestrated through a set of follow up correspondence) resulted in a final bid over $700k, which is higher than recent sales for comparable homes. On top of that, the buyer dropped all contingencies (even the appraisal contingency - which initially did not seem relevant, until the final bid exceeded the comps). This agent played the game perfectly, and the winning bidder got taken to the cleaners. But why am I telling you this story?

Because negotiations are this agent's competitive advantage. He knows how to play the game, and you're not going to win against him. You too have a competitive advantage, and so do I. My competitive advantage is software. I build tools that automate my tasks. I can analyze deals faster, I can manage properties remotely, I can predict market trends, and I can do it all without leaving my house. I geek out about real estate research and I love finding underpriced markets. This is how Investomation was born, it started as a hobby project of mine.

When we leverage our competitive advantage, we win. We get better deals, better leverage, better bang for the buck. When we instead follow the herd and play into our weaknesses, we lose. Too many people play into their weaknesses and then complain that life is unfair. If you play into your weaknesses you will always be one step behind. What's worse is that sometimes you'll be forced to play into your weaknesses because your partner/spouse doesn't understand your strengths and insists on playing a losing game. This is why conversations are important.

For example, if both you and your spouse have remote jobs, it makes little sense to live in an expensive city, especially if your remote salaries don't compete with the local ones. According to Forbes, as many as 28.2% of jobs are now remote in some capacity, and that number is even higher for white collar individuals. Having a remote job is an extremely strong advantage, but many squander it. We create arbitrary requirements for ourselves that make our lives harder. As of 2024, it takes a combined family income of $319,738 to live comfortably in Boston. Comfortably means not living paycheck to paycheck and being able to go on vacation once or twice a year - a modest lifestyle. Can you imagine what you can do with such a salary anywhere else in the US?

You don't even need to go far. The same $700k the buyers spent on a home in Dedham could buy a mansion in Bedford, New Hampshire - a neighborhood with a superior school system to Dedham that's just an hour-drive away. Take a look at a typical home there costing the same $700k:

This means that a family making $300k, which is "barely making ends meet" in Boston would live like royalty in New Hampshire. On top of that, they'd save $20-25k on taxes, because there is no income tax there. To put things in perspective, $25k/year could allow them buy an even more extravagant home (one that costs up to $200k more), travel to Europe 5 times/year, buy 2 brand new Teslas (each costing ~$70k), or put their kid in a private school. Would you rather live in a tiny home and have your kids go to a public school that brainwashes them with populist crap or live in a mansion and have your kids go to private school that equips them for success (for the same amount of money)? It seems like a no-brainer.

Home-buyers aren't the only ones making silly decisions like this. Many real estate investors choose to buy crappy deals in their back yard despite superior ones available in other states - deals that cashflow better, that appreciate better, and that are actually easier to manage because local governments there don't hate landlords.

There is a common fallacy that if you buy real estate locally, you can self-manage it. What many investors don't realize, however, is that they have no business self-managing properties, especially if they have a full-time job. Unless you're focusing on real estate full-time, property management is NOT your competitive advantage. You should outsource it. And if you're going to outsource it anyway, it doesn't matter if the property is 5 minutes away or 5 hours away. While remote property management is not without headaches, technology has made it significantly easier. You don't even need an on-site manager anymore, but that's a topic for another blog post.

Similarly, unless you're focusing on real estate full-time, analyzing deals is NOT your competitive advantage. Use tools like Investomation to save time and money. In the time you'll analyze one deal on paper and compare it to a couple recent sales, we'll analyze historical trends for the entire geographic region going decades back, compare correlations across thousands of metrics, predict demographic shifts and gentrification using AI and recommend the ideal location for your investment based on your risk profile and goals. Sign up for our newsletter and we'll walk you through the steps to buying your first property, help you find ideal locations, and even provide you with remote property management solutions.