MicroStrategy: Unpacking the Elephant in the Room

If you've been following the stock market during the last few months, you may have noticed MSTR stock casually climb 175% in price. MicroStrategy (MSTR) has become a fascinating case study into corporate use of Bitcoin to guard against inflation. But what started as a simple inflation hedge has now evolved into something more. Many critics (like this one) are still fixating on the Bitcoin premium MSTR stock represents, and even poking fun at MicroStrategy's software operations, as if any investors are buying the stock for their software.

If you've been following the stock market during the last few months, you may have noticed MSTR stock casually climb 175% in price. MicroStrategy (MSTR) has become a fascinating case study into corporate use of Bitcoin to guard against inflation. But what started as a simple inflation hedge has now evolved into something more. Many critics (like this one) are still fixating on the Bitcoin premium MSTR stock represents, and even poking fun at MicroStrategy's software operations, as if any investors are buying the stock for their software.

What is MicroStrategy? Is it just a proxy for Bitcoin? Not quite. MicroStrategy is an economic experiment where the world of traditional finance meets the world of cryptocurrencies. In 2020, this stock represented one of the few opportunities to get crypto exposure in your regular stock-trading or retirement (IRA) account. There were other options to do the same, such as GDLC, but they charge an unjustifiably high management fee (2.5%).

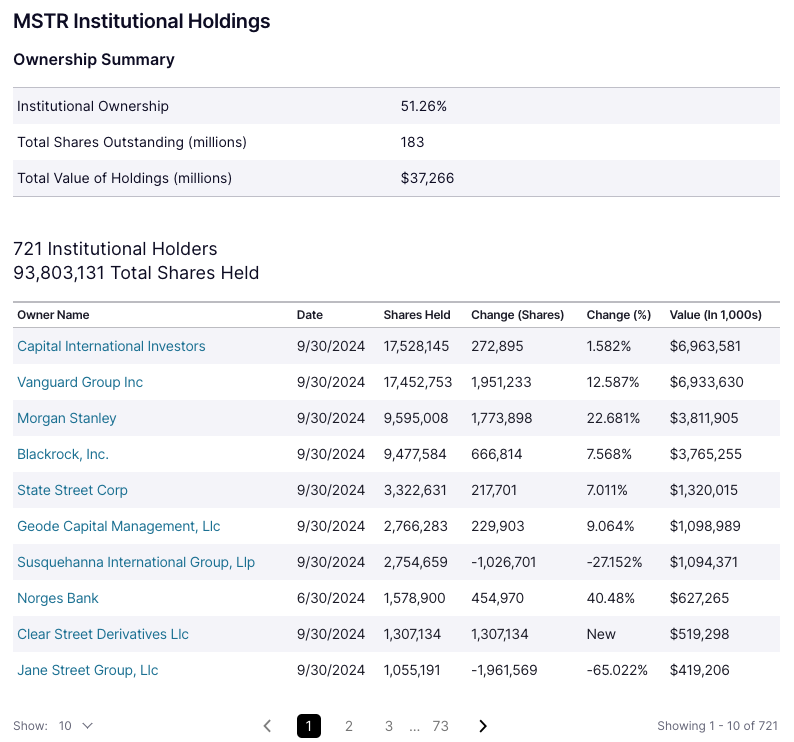

Turns out retail investors weren't the only ones allured by this opportunity. Institutional investors started noticing MSTR too.

Institutional Backing

On the surface, it seems like the recent MSTR price spike is due to a bunch of r/wallstreetbets degens aping in during the Bitcoin mania. However, if you check Nasdaq, over half (52%) of its investors are institutional, including pension funds, which are historically aligned with long-term strategies. These are not “dumb money” investors prone to panic selling. The lists includes giants like Vanguard, Blackrock, and Morgan Stanley. Their vision, like MicroStrategy is 30+ years from now, they're not judged by their returns today like a traditional hedgefund.

This gets me to my next point. What can a business do when it has the backing and attention of the largest financial institutions in the country? Easy leverage!

This gets me to my next point. What can a business do when it has the backing and attention of the largest financial institutions in the country? Easy leverage!

Reinvesting Bitcoin Back Into Bitcoin

You're not buying into a Bitcoin proxy, you're buying into a Bitcoin-generating machine.

MicroStrategy has built a mechanism akin to a dividend reinvestment plan (DRIP) but tailored for Bitcoin. They use debt—secured at near-0% interest rates and with no risk of margin calls—to purchase BTC. Their earliest loan matures in 2029, giving them ample time to execute their vision. I'm not going to go into too much detail on math here, as others have already done a better job.

The bet is straightforward: BTC needs to be worth at least $42k (their current buy-in average) by 2029 to justify their investment. This isn’t just wishful thinking—it’s a calculated risk based on the intrinsic value and growth potential of BTC.

MicroStrategy’s approach is reminiscent of real estate investment strategies I've shared in my previous blog posts. They issue mortgage-like debt that can’t be margin-called, and they structure this debt with the potential for conversion into equity under favorable terms. This is basically a "syndication" with BTC being the "real estate" being acquired, secured by existing BTC collateral.

At the heart of their model is the principle of compounding. By reinvesting their gains into BTC, they create a snowball effect that yields exponential returns, but these returns are not in dollars. They're in BTC, hence the price premium. You're not buying into a Bitcoin proxy, you're buying into a Bitcoin-generating machine.

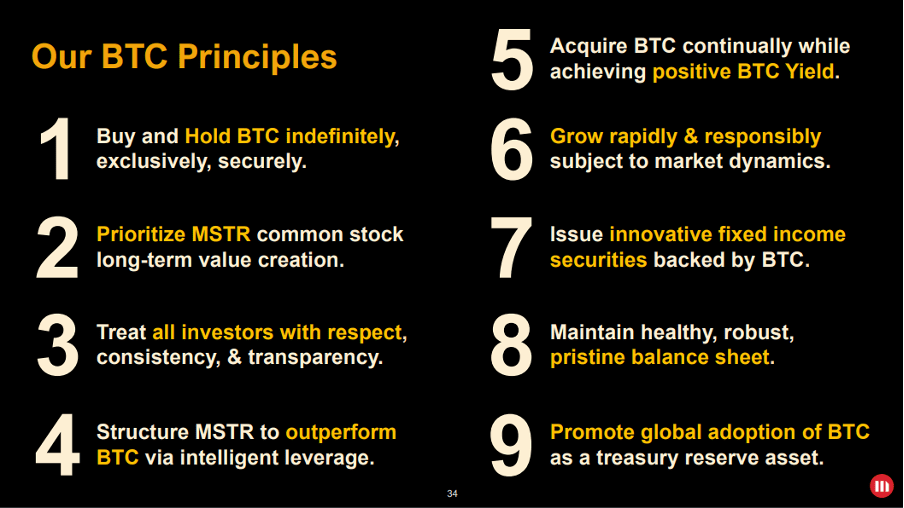

Saylor makes this clear in MicroStrategy core principles, just that most people haven't been paying attention:

Indeed, MicroStrategy has been very consistent on execution of those core principles as we see from their total Bitcoin Holdings:

Indeed, MicroStrategy has been very consistent on execution of those core principles as we see from their total Bitcoin Holdings:

If you were to buy a business, you would pay a multiple of its annual earnings. Similarly, a common approach to valuing stocks is their P/E ratio, except in this case the earnings happen to be in BTC. As MicroStrategy's BTC holdings grow, they can borrow more against their collateral to grow their BTC holdings faster, a strategy similar to the BRRR approach in real estate.

If you were to buy a business, you would pay a multiple of its annual earnings. Similarly, a common approach to valuing stocks is their P/E ratio, except in this case the earnings happen to be in BTC. As MicroStrategy's BTC holdings grow, they can borrow more against their collateral to grow their BTC holdings faster, a strategy similar to the BRRR approach in real estate.

Challenges and Risks

This strategy isn't perfect. Black swan events that we're not anticipating could derail the plan. The growing value of MicroStrategy’s BTC holdings makes it a prime target for hackers. Groups like Lazarus have a history of targeting crypto assets. Russia and China also have strong incentives to sabotage US economy and this would surely be one of the entry points they'd explore. Let's hope MicroStrategy is better as securing their keys than Harmony was, otherwise their stock will plummet faster than Sam Bankman-Fried's reputation.