Housing Starts

At the recent Mastermind with Daniil, he suggested adding data for housing starts. Housing starts refer to the number of new residential construction projects that have begun during a specific period. It is an important indicator of the health within the housing market. A high number of housing starts can indicate strong economic growth and consumer demand for housing, while a low number can suggest weakness in the market. This data is closely monitored by investors to assess the stability and trajectory of the housing sector.

At the recent Mastermind with Daniil, he suggested adding data for housing starts. Housing starts refer to the number of new residential construction projects that have begun during a specific period. It is an important indicator of the health within the housing market. A high number of housing starts can indicate strong economic growth and consumer demand for housing, while a low number can suggest weakness in the market. This data is closely monitored by investors to assess the stability and trajectory of the housing sector.

This seemed like a good idea, and something I haven't thought of before. The only problem was obtaining that data, to my knowledge it does not get publicly published. What does get published is the number of residential permits issued each year, since those are tracked by Census at a county level. It's not quite the same as housing starts, since construction may start several months or years later. In Massachusetts, for example, a permit is good for 2 years, and you can usually extend it further, if needed. This means that people may choose to sit on the permit for several years until the economy turns around instead of starting new construction going into a recession.

But statistically, a significant portion of those permits will probably break ground within 6-9 months. That means that permit data itself may often be good enough for housing start estimates. The problem is, like all Census data, there is about a 2-year delay publishing this data. The data available now is from 2021, so unless we find other relevant data that's more recent, the logic powering Investomation's prediction engine, unaware of the looming recession, will continue extrapolating that trend.

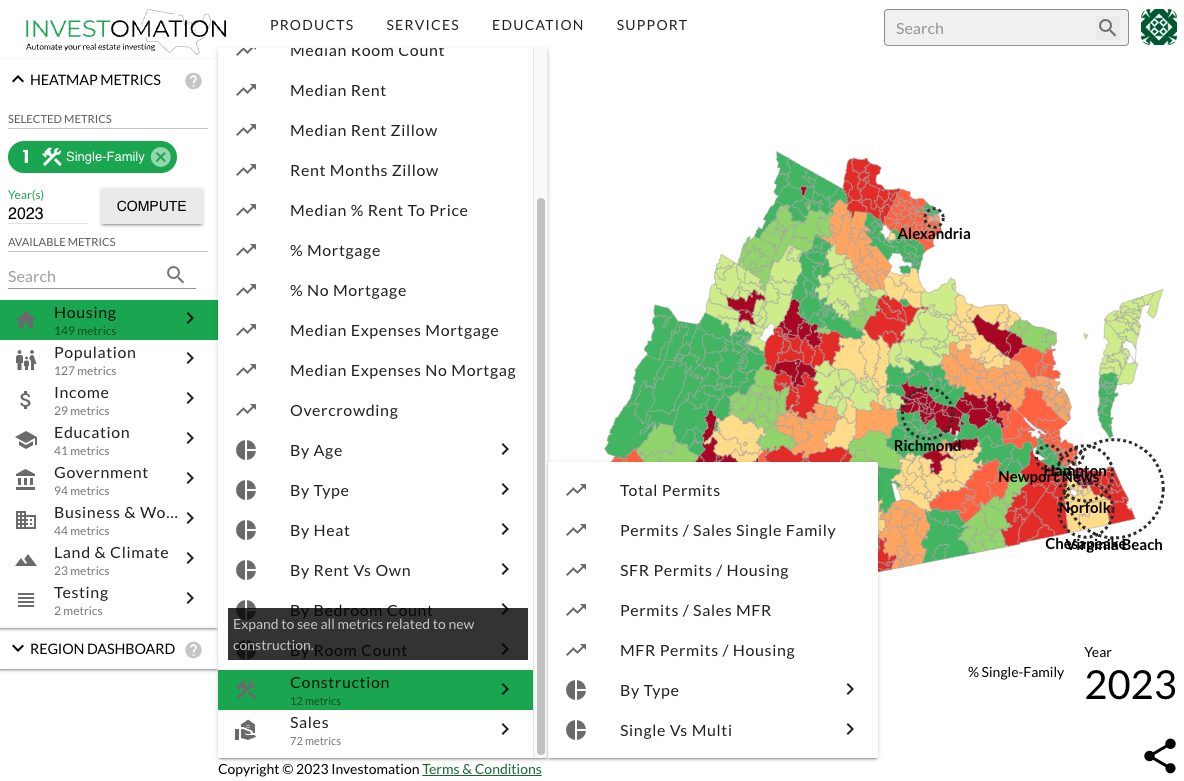

Luckily for us, there is another source of data which correlates with housing starts that's more current: The Yield Curve. I've already published the permit data, which you can access under the Housing > Construction section on the map. Keep in mind that the permit application data published by Census is limited to county level. That means we have no idea which zipcode that data comes from since no one tracks individual addresses (for privacy reasons).

As for the yield curve itself, I'm still working on incorporating it into the predictive engine. Once complete, the engine should be able to anticipate other economic trends as well, which could improve predictions for metrics like job growth and unemployment rate as well.