Cryptocurrency: Out of Favor, But Not Out Of Touch

The cryptocurrency market had a run-up in 2020, with many altcoins reaching all-time highs. Since then, however, the hype surrounding cryptocurrencies has died down, and the market has cooled off. Some well-known players like Luna and FTX had spectacular falls from grace last year. As a result, most people have begun to view cryptocurrencies as a bubble that popped. The masses, however, would have said the same thing about the car in early 1900s and internet in the 90s. The truth, however, is that crypto is just getting started.

The cryptocurrency market had a run-up in 2020, with many altcoins reaching all-time highs. Since then, however, the hype surrounding cryptocurrencies has died down, and the market has cooled off. Some well-known players like Luna and FTX had spectacular falls from grace last year. As a result, most people have begun to view cryptocurrencies as a bubble that popped. The masses, however, would have said the same thing about the car in early 1900s and internet in the 90s. The truth, however, is that crypto is just getting started.

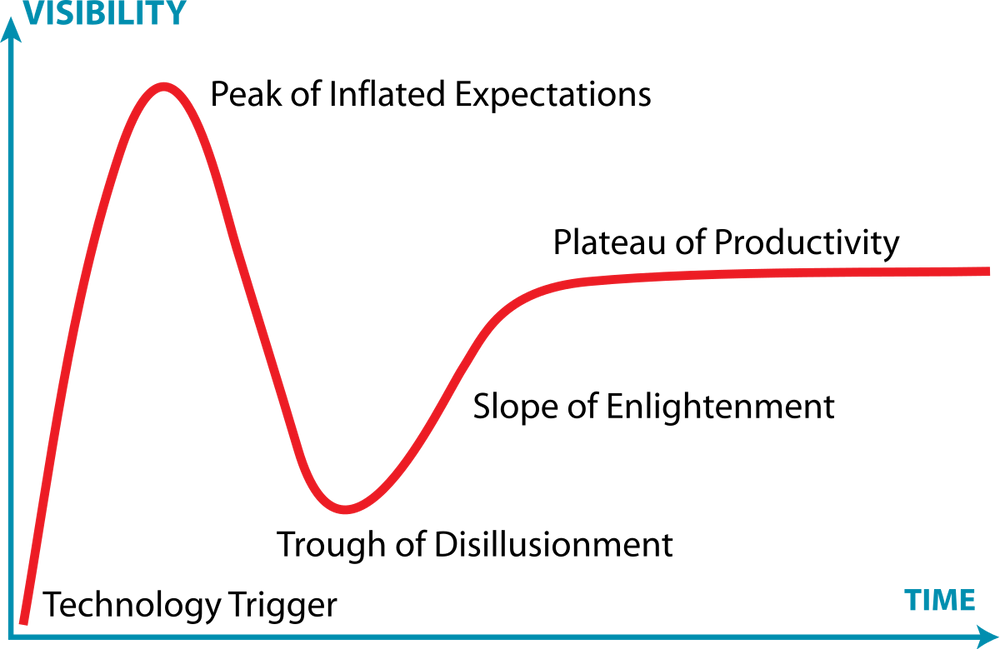

The technology behind cryptocurrencies is still very much legitimate. We're just going through a trough of disillusionment. The market is figuring out what works and what doesn't, and people are becoming more discerning about what they're investing in.

One of the main criticisms of cryptocurrencies is that they're mostly speculative. People are buying into NFTs (non-fungible tokens) without much consideration for what they're actually investing in. I'll be the first to admit that most crypto projects are garbage. But, let's be honest, most startup ideas in general are garbage, crypto just made it easier to raise startup capital. And that's the key here, crypto made it easier to invest into startup companies before they're public. The key is to find the diamonds in the rough. The regular investor can finally do the same thing Peter Thiel did to build his fortune.

The way to invest into cryptocurrencies is to focus on the underlying technology, not the hype. Ignore BitBoy and other scammers, he makes his money from the marketing budgets of the very projects he pumps. What his followers are doing is equivalent of playing a lottery, and lottery is a tax on the uneducated. Do not buy speculative assets with complex tokenomics that make their money on the derivative of a derivative of a tweet.

Smart contracts, however, are legit. They are the digital machinery of a business, a franchise-like entity if it's structured right. You need to invest into protocols that do something useful with those funds aside from speculation, with a competent team behind them. This is what will drive real value in the long run. This is the same thing investors have already been doing in stocks and real estate for centuries. The technology is novel, but your approach to investing should not be. Don't speculate, invest into cashflow instead.

At Investomation, we believe that the next breakthrough niche for crypto will be real estate. We're already integrating smart contracts into our logic, and we see a huge potential for reducing overhead fees, allowing fractional ownership, and making it easier to connect people who have access to good deals with those who have access to funds needed to make those deals happen. Smart contracts could revolutionize property records, tenant background checks, and may even simplify evictions. It will be easier to show proof of funds to lenders, as well as property's rental history. Finally, it will allow those who're currently excluded from investing in real estate (those without enough capital and foreigners) to particupate in it.

But even this is just the tip of the iceberg. A blockchain is effectivelly a public database, that never goes down as long as there is at least one computer online. That means data can remain useful long after the project is gone, long after the founders have moved on, as long as the public sees value in keeping that data online. Imagine if we used the blockchain as a giant open-source collective of demographics data, tax data, weather data, manufacturing and business data, all standardized across the entire world. No more trying to normalize data across thousands of local agencies, no more data gatekeepers. And best of all, like with sharing economy, the people getting paid for this data would be the very locals with expertise of a given market. It's another revenue stream for data providers with fewer middlemen in the system.

We're committed to making real estate easier to invest in, and we believe that cryptocurrencies will play a big role in making that happen.